A few days ago Forbes released its annual The Business of Baseball list. The Pirates are one of two teams that saw a negative 1-year value return in 2019.

Forbes Business of Baseball list is a great benchmark to observe the high-level changes in all 30 MLB team’s fiscal outlook. This article will walk through the numbers for the Pirates, analyze how they compare to the rest of the teams in the MLB, and explain what it means for the 2020 Pirates.

Let’s start with one of the numbers that sets the Pirates apart from the majority of the other teams – yearly value change. The 2019 Business of Baseball list which analyzed the team’s financial standing in 2018 valued the Pirates at $1.275 billion.

Currently, the Pittsburgh Pirates are valued at $1.26 billion. This resulted in a yearly value change of around -1%. With the majority of baseball still raking in money, this negative value change puts the Pirates as one of only two teams that lost value over the course of 2019. The Miami Marlins were the only other team that had a negative value change (-2%).

The decrease in team value is obviously tied to poor on the field performance, poor public perception, and poor management decisions. All of these factors attributed to negative fiscal trends, including a 2019 gate revenue of $44 million for the Pirates. Gate revenue is simply ticket sales, a major source of revenue for any MLB team. This is the third straight year the Pirates experienced a decrease in gate revenue, down from $70 million in 2016.

However, the drop in gate revenues only accounts for a small amount of the Pirates’ value change. The team at Forbes states,

"[The team valuations are] based on historical transactions and the future economics of the sport and team. Revenue and operating income (earnings before interest, taxes, depreciation and amortization) measure cash in versus cash out (not accrual accounting) for the 2019 season…Sources include sports bankers, public documents like leases and filings related to public bonds and media rights."

My take on that statement is that while some of the negative valuation is based on hard metrics like gate revenues, other parts of the valuation is based on subjective expert analysis and the team’s brand as a whole. In fact, Forbes provides a sort of break-down that covers all of these parts. The four-part breakdown is as follows:

Sport – Portion of franchise’s value attributable to revenue shared among all teams.

Market – Portion of franchise’s value attributable to its city and market size.

Stadium – Portion of franchise’s value attributable to its stadium.

Brand – Portion of franchise’s value attributable to its brand.

The Pirates saw a decrease in all four of these categories during the course of the 2019 season.

Numbers from the 2019 and 2020 Forbes Business of Baseball.

Values in millions of US dollars

As a fan this is a disturbing picture. While baseball as a whole thrived in 2019, the Pirates found a way to struggle. In fact, the only reason their financial valuation was not even worse is due to the increase from $551 million to $587 million in revenue sharing.

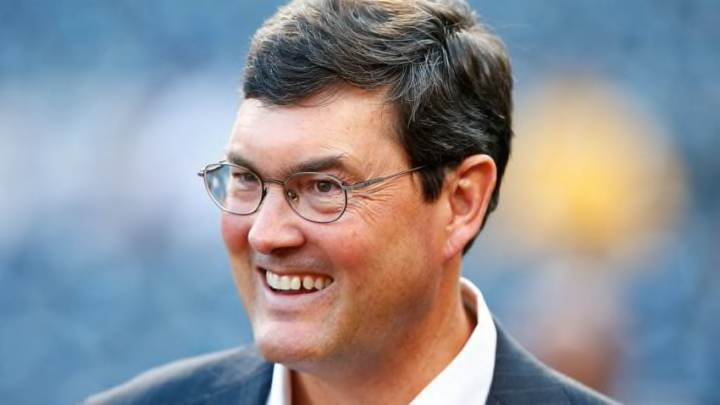

Actually, I should clarify. The Pittsburgh Pirates, not including Bob Nutting, found a way to struggle financially in 2019. The business still brought in $273 million dollars in revenue according to the report. But of course the franchise, the team, the brand, etc. all came out on the short end of the stick.